The Business Side of the Creator Economy 💰 - Issue #10

Hey y'all 👋

Question for you this week: What's a strange fact about you?

Mine is "I sneeze when I go outside and it's sunny"

Now you know.

🌞

Today we'll tackle:

- Remote Communication Masterclass 🏝

- Transformation Alternative-based Pricing 🧜♀️

- Update on the EU VAT situation for creators 🇪🇺

- The business of investing in creator companies 💰

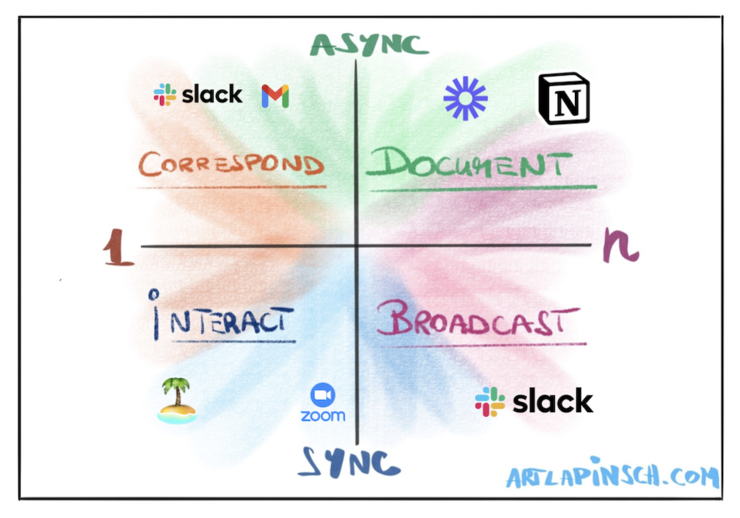

Remote Communication Masterclass 🏝

Last week I gave a Zoom session about Building Remote Companies.

I even received a shoutout from a former elite soldier. 👨🏭

The part of the session, which seemed to resonate the most was the topic of communication.

- How to build culture in a remote setup?

- How to not waste away in endless Zoom Marathons?

- How to make sure everyone knows what needs to be done?

That's why I'm building a transformational learning experience to make remote communication suck less.

If this is interesting to you, ping me directly.

Please forward this signup page if you know someone who would benefit from this 👇

Remote Communication Masterclass

Zoom Fatigue, Loss of Connection, Missing Documentation? It's time to enable your team to thrive in a remote world 🏝

How exactly will the course look like?

- 2 workshop days (3-4 hours on Friday and Saturday)

- 10-20 participants (audience: managers of remote teams) to connect and exchange learnings

- Repository of best practices and templates from world-leading remote organizations (GitLab; Buffer; Zapier; etc.)

- Access to online community to connect and ask questions even after the workshop days

I aim to have the first iteration of this masterclass ready by June.

If you have feedback, critique, questions, thoughts, please reply to me via email. 🙏

Finance Rules Everything in the Creator Economy 💸

When people hear "creator economy" they think of YouTubers who run around with a GoPro.

But behind every successful creator there's a solid foundation of business acumen.

One aspect, which gets frequently overlooked is finance.

This week I'll outline 3 cool examples:

Pricing: Don't Sell Yourself Short

Creating an educational online product might come easy.

2 hour screen recording. Upload on course platform. Distribute.

A common pitfall is to price a digital product according to (a) effort [in this case 2-3 hours] or (b) length of content.

This can lead to problems:

- Little/no margin for creator

- Little/no push for student to complete the course

It's a lose-lose scenario.

Instead, my ODCC colleague Sir Steven Wilkinson recommends Pricing by Transformation Alternative 👇

🤯'Transformation Alternative'🤯

— Art Lapinsch 🔋 🌳 🛡 (@artlapinsch) May 9, 2021

Biggest takeaway personally was "pricing by transformation alternative"

❌Price by calculating your cost and effort + markup

✅Price by calculating what it would usually take to achieve the same level of transformation for the customer

Instead of thinking (your effort + length of content), think of student's effort (time + money) required to achieve the same transformation.

In my case it would mean benchmarking against an operational consultancy with long project duration and hefty hourly rates. 🤔

It's one of the coolest concepts I've heard in a while.

I will test it for sure.

Taxation: The European Convolution (Part 3)

Maybe you remember me writing about my EU VAT 🇪🇺 woes here and here.

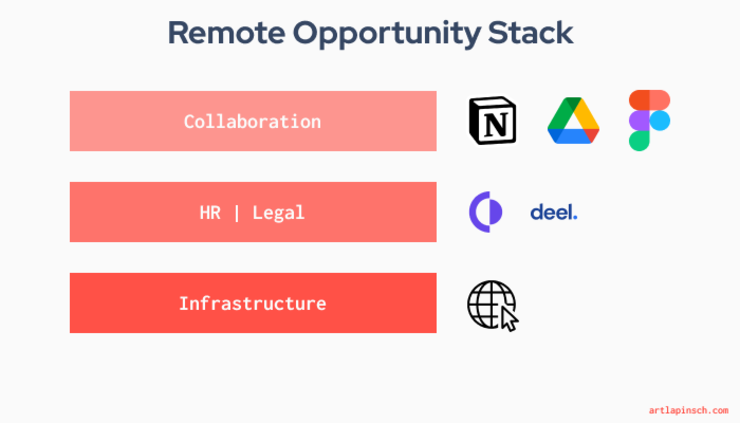

My current solution is an updated creator stack:

- Stripe (payment processor): Thank god I'm off Paypal. Stripe takes a transparent cut (~2-3%) on my total transaction volume.

- Podia (course platform): I switched from Gumroad to Podia, since they support Stripe AND have a good feature set for course creators. Also, Podia has the ability to collect location-specific VAT but I'd still have to remit to local authorities.

- VAT Exemption (checking via tax advisor): Since I'm a 🇩🇪 sole proprietor I can apply for VAT exemption for small businesses. The threshold in DE is <10k and we are checking if that's applicable.

- e-Residency + Estonian incorporation: I applied for my 🇪🇪 e-Residency and hopefully am able to incorporate a business asap. Once that's in place I can apply for a MOSS (Mini-One-Stop-Shop) tax remittance setup for EU VAT. This means, I collect VAT locally for EU customers, but remit only to one tax authority (in this case: Estonia) and they deal with the downstream tax remittance to the local authorities.

Investment: Running a Holding Company for Creator Businesses

I listened to one of the coolest discussions about creator businesses.

Content to Commerce - Colossus

My guests this week are Jesse Jacobs and Mike Kerns, co-founders and partners at The Chernin Group, TCG, a multi-stage investment firm dedicated to building consumer businesses. Many think of TCG as some of the best media investors in the world, and in this discussion, you’ll quickly see why. In our conversation, we cover how TCG identifies creators that they can help build businesses with, how established companies should think about influencers and media today, and what innovations they are most excited for in the creator space. As I become more heavily involved in building new media properties, Jesse and Mike are always my first point of call for advice, and I’m so excited to share this with you.

In this podcast Mike Kerns and Jesse Jacobs explain how they:

- Acquire creator businesses

- Incentivize creators to drive value in the long run

- Monetize the content to commerce funnel

- Cross-promote creator funnels across multiple content verticals

I love this stuff.

------

As always, I'd love to hear from you. What's new?

Stay happy, stay healthy 🙌