e-Residency in Estonia 101: Why One Should Register a Virtual Company in the EU

Disclaimer: I'm not a financial advisor and this is not financial advice.

The best thing about it: I did all of it from my laptop 🌐

101: Basics of Estonian e-Residency [this post]

102: Taxation and Cash Flow

103: Becoming an e-Resident

104: Incorporating in Estonia

105: Running an e-Business

This post covers:

- Why everyone is talking about Estonia 🇪🇪

- Why I started an Estonian e-business

- Possible limitations of e-Residency

- Taxes 101: How much and when to pay

- Additional resources

If this sounds relevant to you, strap in.

Teeme seda 🇪🇪

What's the Deal with Estonia?

Why is everyone talking about a tiny little country in the Baltics? 🇪🇪

You might have seen headlines like these 👇

Or maybe someone told you about it.

I'm about to have to register for VAT in the EU and my accountant is recommending the Republic of Ireland because language

— Michael Ashcroft (@m_ashcroft) February 1, 2022

Wondering if I should consider other options though, Estonia has come up a few times as a good place to register for things of this nature

What Is Estonia's e-Residency Program?

Here is some background:

Although the idea of issuing ID cards to non-residents had been discussed at least from about 2007, and proposed again in 2012 ... the concrete proposal ("10 million e-residents by 2025") was presented by Taavi Kotka, Ruth Annus, and Siim Sikkut on an idea contest by Estonian Development Foundation in 2014.

Kotka stated that, while the further goal of the project would be to gain millions of e-residents, its purpose was to increase the number of active enterprises in Estonia.

In short: the e-Residency program is a result of a governmentally-funded hackathon 🤯

... No pressure, kid. What did you build today?

Why Estonia Invites People to Become e-Residents?

Here's my personal analysis of the situation:

Estonia grants access to its economic infrastructure in return for tax revenue. Think of incorporation, banking, and access to the EU market.

- 🛂 Traditional Residency: A person gets a traditional title of stay (work visa; citizenship; etc.) → the person moves to Estonia and is an additional citizen in for the physical infrastructure → the load increases by +1

- 🌐 e-Residency: A person gets a digital status (right to incorporate but no title of stay) → the person does not move to Estonia → the load on the physical infrastructure does not increase (+/- 0)

The kicker of the model is that it doesn't introduce additional load on other parts of the infrastructure like healthcare; security; physical infrastructure, since the e-Residency is a 'digital identity and status'.

At the end of the day it is a win-win situation for both parties:

- Estonia gets incremental tax revenue without additional costs to their physical infrastructure

- Individuals get access to the European Economic Area without the requirement to move at a fair price (cost of e-Residency + flat tax)

I think this is genius.

To date, Estonia has welcomed nearly 90,000 e-residents, who between them have established around 20,000 new companies.

In addition to the indirect economic impact, such as growth among and investments into Estonian companies offering services to e-residents, the e-residency program has generated direct revenue for the Estonian state budget of more than €80 million. (source)

Expect to see more governments produce their own spin on this model.

Osaühing (Oü): The Estonian LLC

So how then do you conduct business as an EU entity?

The answer is 'Osaühing' (commonly abbreviated "Oü").

I'm not quite sure how to pronounce it but suffice to say this legal entity is Estonia's equivalent to a limited liability company (LLC).

A private limited company (known as osaühing or OÜ) is a company that has its share capital divided into private limited company shares. A private limited company is liable for the performance of its obligations with all of its assets. This means that a shareholder is not personally liable for the obligations of the company. The share capital must be at least 2,500 euros.

The minimum capital you have to provide is €2500.

There's one important side-note:

If the founders are private persons and the share capital is less than 25,000 euros, they can decide whether to pay their share when establishing the company or postpone the payment. Until the whole sum has been paid, the founders are personally liable for the missing contribution.

This means that fully limited liability is granted when the share capital exceeds €25000. Up until that point, you as a founder are liable for the difference between this number and what you have paid in as share capital.

Practical Example: I paid €2,500 in share capital and suddenly the company is liable to cover 1 million euros in damages because of some business risk (economic; compliance; fraud/security; financial; reputation; competition; operational). In that case, I would be personally liable for €22,500 (i.e. €25,000 - €2,500). The rest of the liability would roll over to the company.

Why is it structured that way? Governments wanted to facilitate access to limited liability - in order to promote entrepreneurial endeavors - and hence reduced the minimum share capital needed. In most cases, it is advised to use your retained profits to contribute towards the share capital until you have full coverage.

I still remember the days, when a limited liability company could be incorporated ONLY IF you would provide the full share capital upfront - in this case, the €25000. So the new setup is a vast improvement.

This is something best discussed with your accountant and/or financial advisor.

Legalese out of the way ✅

Off to some practical use cases 👇

Why Did I Start an Estonian Business?

I think it's easiest to talk you through my personal reasons for incorporating an OUe.

📑 Reduce Bureaucracy

If you are tired of going to the notary for every single change (e.g. update address; change share capital contribution; etc.), then you and I are not so different.

I wanted to test how it feels to run a company fully remote.

Estonia, son 🇪🇪

— Art Lapinsch 🐽 (@artlapinsch) November 25, 2021

Bureaucracy be gone.

💶 Simplify Taxation

Estonian e-businesses have (a) a straightforward tax calculation and (b) all of it can be done online.

No paper. No problem.

I'll dive into money flows and taxes in more detail further below 👇

🔮 Experience the Future

“The future is there... looking back at us. Trying to make sense of the fiction we will have become.” - William Gibson

It's pretty cool to be a digital citizen of a country you've never set foot in.

More importantly, having access to your corporation from a browser is great. All the information is in the cloud and you can manage a business while traveling.

... and yes, I have no shame in plugging that Gibson quote. Deal with it.

☝️ Good Fit for Solopreneurship

My current philosophy about work and entrepreneurship is to build my own portfolio of micro-businesses.

If you are a solo founder and don't plan to raise traditional venture funding, then running a lean and mean OUe can be the way.

Are there any successful examples of Estonian e-businesses at scale?

Yes! Plausible.io comes to mind. They are building a privacy-friendly alternative to Google Analytics.

Check them out. Their blog is fantastic.

What Are Possible Limitations of the Estonian OUe?

As of now, I can think of 2 types of businesses, which are not suitable for the ‘Estonian Way’.

🚀 Venture-funded Startups

If you are interested in hyper-growth you will eventually look at institutional funding sources (VCs; etc.) for a cash injection.

VCs give you money for a part of your company’s equity/shares. The Estonian e-Residency scheme is rather exotic and funds are more comfortable with Delaware C-Corps (US) or UK LLCs (UK). They would most likely ask you to re-incorporate before the funding round can be closed.

If you are shooting for the moon use Stripe Atlas or AngelList Stack to incorporate as a Delaware C-Corp.

🏦 Local Business

If you exclusively [a] operate in and [b] serve customers from one region (e.g. based in Berlin and only serving German customers) then your local tax authorities will classify your business as a local tax resident.

Disclaimer: I keep on learning more and more about this topic and am far from being a pro. This is my best understanding at this point.

Tax 101 and Other Money Matters

Let's talk about the moolah 🤌

What Do You Pay Tax on in Estonia

For limited liability companies, Estonia taxes 2 things:

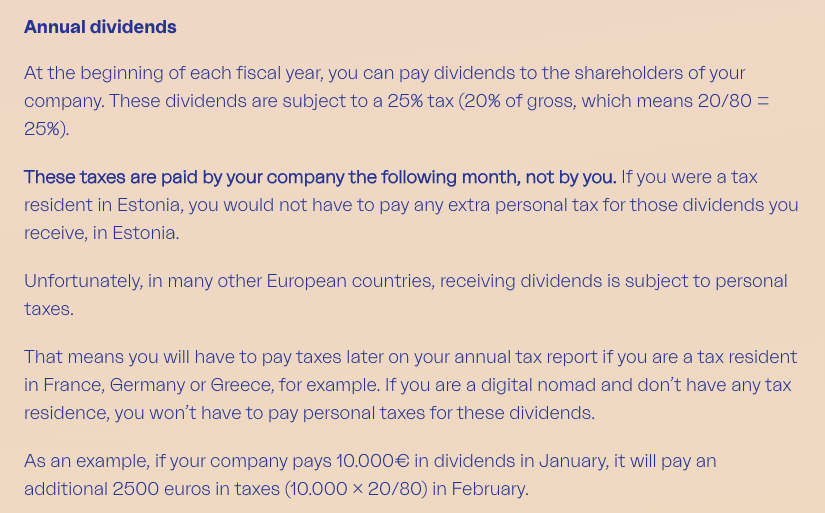

#1: Dividends 💰 = Profits, which leave the company as payouts.

Profits of the current financial year (FY) can be paid out as dividends only in the following FY.

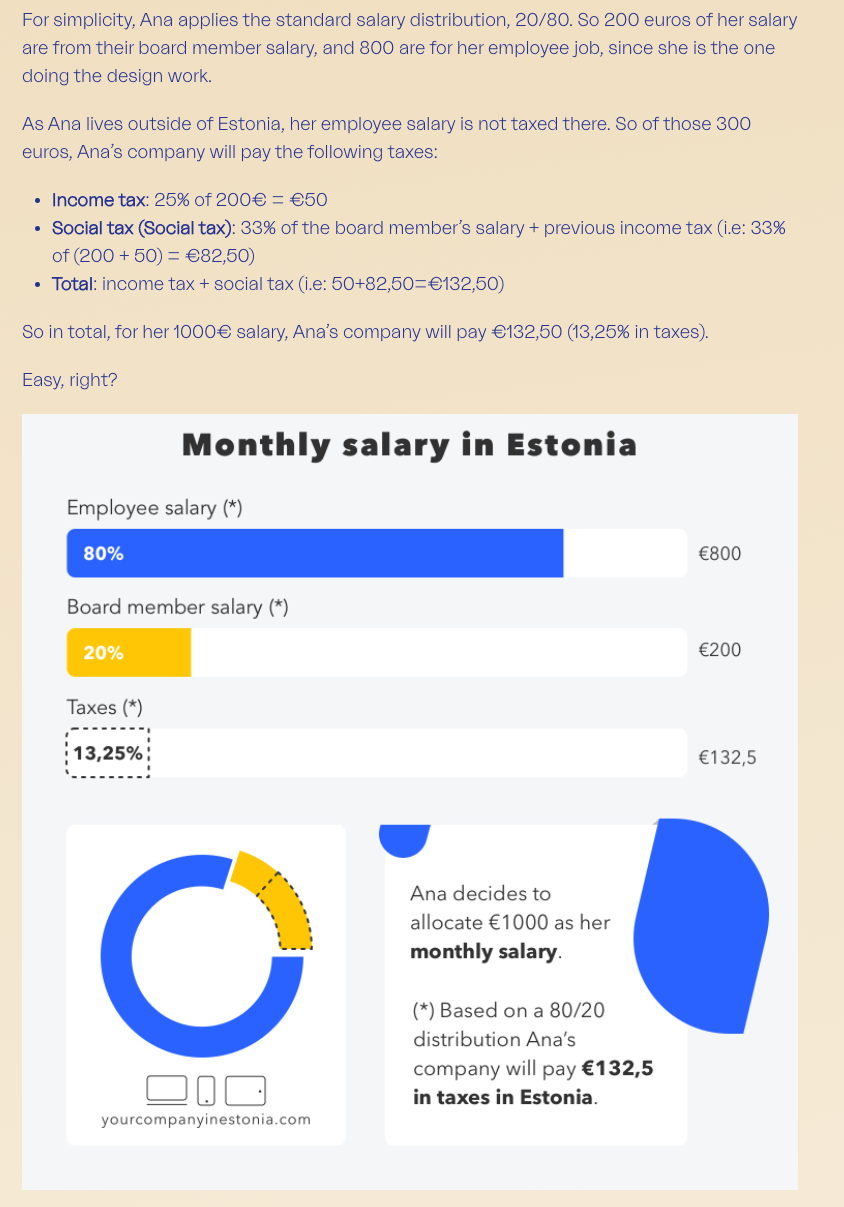

#2: Board Member Salaries 👔 = Compensation for managerial tasks.

If you run a one-person operation certain tasks will need to be classified as board member activities and the rest as employee activities.

That’s why you’ll eventually end up having a salary split between board member compensation and employee compensation.

When Do You Pay Your Taxes in Estonia

One of the particularities of Estonia is that all undistributed corporate profits are tax-exempt.

Simply put, as long as you don't pay dividends or pay managerial compensation, you can park your corporate profits within the entity and it will not be taxed.

This point is huge because it avoids the typical year-end scramble to find "justifiable expenses" to reduce a company's tax liability.

Bottomline: A Viable Option for Remote Solopreneurs and Freelancers

An Estonian e-Residency + incorporation of an OUe can be an interesting option for people who want to benefit from:

- Access to the EU market 🇪🇺

- Straight-forward taxation 💶

- Reduction of bureaucracy 🛂

- Ability to run a business remotely 🌐

I hope this introductory post helped you to warp your head around Estonia's e-Residency program.

If you have questions/comments/feedback/etc please ping me on Twitter 🙌

Additional Resources

- What is e-Residency (Estonian Government)

- private limited company (Invest in Estonia)

- Five years of e-Residency: past, present and future (Ott Vatter)

- How taxes and VAT work for Estonian companies (Companio)

- 2021 saw as many new e-Residents as births in Estonia (ERR)

- In the event of a crisis, Estonia plans to rely on its allies to hold its critical systems (ZDNet)