e-Residency in Estonia 102: Cash Flow and Taxation

Disclaimer: I'm not a financial advisor and this is not financial advice.

The best thing about it: I did all of it from my laptop 🌐

101: Why to Set up Shop in Estonia

102: Cash Flow and Taxation [this post]

103: Becoming an e-Resident

104: Incorporating in Estonia

105: Running an e-Business

How Much Money Do I Have Left at the End of the Day?

When deciding between different forms of incorporation, people ultimately ask themselves: "What's my take-home?".

Maybe you can add some examples or case studies, or comparisons? E.g. "if I invoiced all of this in Germany, then I would pay xyz, but if I invoice via my company in Estonia than I pay abc, and for the salary I pay myself it means etc etc.

— Valentina Thörner (@ValeDeOro) February 1, 2022

To answer these questions, I'll use this post to cover:

- 💰 Basic Questions of Taxation

- 🗓 My Specific Incorporation Setup

- 🧮 Comparison of Cash Flows and Taxes Between Setups

A Thing or Two About Taxes

The topic of taxation can be as complex as you want it to be. Especially if you start drilling down into the details.

To simplify, I am asking myself a couple of high-level questions instead 👇

What type of tax are we talking about?

- 🙋 Personal: What do I have to pay as an individual?

- 🏢 Corporate: What do we have to pay as a legal entity?

Discussing cross-border taxation - especially being an owner/shareholder of a corporation - always means you have to look at tax liabilities from a corporate AND a personal perspective.

In the case of Estonian e-Residency, this would usually mean that corporate taxation is looked at from an Estonian point of view and personal taxation depends on where you are being considered a tax resident.

Example #1 (Austrian citizen; living in Germany)

- Corporate tax payable in Estonia 🇪🇪

- Personal tax payable in Germany 🇩🇪 → usually no tax in Austria, since there's a double taxation agreement

Example #2 (US citizen; living in Germany)

- Corporate tax payable in Estonia 🇪🇪

- Personal tax payable in Germany 🇩🇪

- Personal tax return requirement in the USA 🇺🇸 → US citizens living abroad must file with the IRS + pay personal income taxes above a certain income threshold

It's best to consult a tax advisor and have a professional look over your specific situation.

I am using a tax advisor to help me with my setup. I would highly advise you to do the same.

The How, What, When of Taxation

- How (much): What are the various tax rates? What tax bracket do I fall into (families vs. singles; etc.)?

- What: What type of income is being taxed?

- Who: Are my customers EU-based? Do I need to collect & remit VAT?

- When: When do you have to pay your taxes?

These four variables determine your effective tax liability - how much and when you pay it.

Second and Third-order Effects of Taxation

Does being a tax resident in one country have an impact on me being a tax resident in another country?

Is this recommendation only for startups that want to go the VC/funding way? Because I believe for bootstrapped companies who want to get profitable and pay dividends the US Inc makes it rather complicated from a tax perspective.

— Alexander Peiniger (@alexpeiniger) December 2, 2021

Frequently this involves reading through double taxation agreements (luckily EU-wide + US are somewhat standardized with most countries being in some sort of agreement).

Some of the possible considerations you want to check

- Dividends: When can you distribute profits?

- Fundability: How easy is it to get venture funding for this particular incorporation type? (e.g. US investors primarily invest in Delaware C-Corps since they are most familiar with its legal and tax-specific implications)

But I still think that in my case Germany would argue that the business is actually run from Germany and would tax the company with the German corporate tax.

— Alexander Peiniger (@alexpeiniger) December 3, 2021

- Tax Residence: Note which countries you are touching (personal residence; company incorporation; citizenship) and see if there's any risk of either of those countries considering you or your company as a tax resident.

Makes sense 👍

— Alexander Peiniger (@alexpeiniger) December 3, 2021

My Personal Setup: How Am I Currently Organized and Incorporated in Germany and Estonia

Here's a quick summary of my solo setup:

- I'm an EU citizen 🇪🇺

- My primary residence is in Germany 🇩🇪

My business activities are broadly split into 3 buckets:

#1: Freelance Activities in Germany 🇩🇪

You need to register a separate tax ID number for each type of freelance activity you want to offer.

I have one tax registration for Business and Marketing Consulting Services.

I bill my freelance work and use it to expense any type of office-related costs (computers; ongoing education; etc.)

This is what I'm using for income recognition of my digital products on Gumroad.

I have another registration for Artistic Work.

In 2020/21 I produced and published a music album. Should I ever get streaming/sales revenue I'll have to run it through this particular tax ID. Also, I can expense activity-specific costs (instruments; software purchases; mixing/mastering expenses; contractor payments; plug-ins).

#2: Angel Investing via German Corporation 🇩🇪

I registered a German limited liability corporation for my angel investments.

The entity is called UG (Unternehmergesellschaft) which is similar to a GmbH (Gesellschaft mit beschränkter Haftung) - which is the most common limited-liability company structure in Germany.

A small difference is that in a GmbH you need to deposit €25k in nominal capital for incorporation and registration purposes but for the UG your nominal capital can be as little as 1 euro BUT you have to retain all profits up until they make up €25k in nominal capital. Then you can start distributing profits.

The main reason to incorporate as a limited liability company for angel investing is that the profits are treated as corporate income and are not taxed at inflow but only once you close the financial year. This gives you the option to re-invest your investment returns. You are taxed once you want to distribute profits.

#3: e-Business in Estonia 🇪🇪

In 2021, I registered an Estonian limited liability company - initially out of curiosity.

I incorporated my e-learning company 'remote fabric' in Estonia.

The main reasons I chose to incorporate as an Estonian limited liability company:

- Credibility: My target audience is B2B customers and I wanted to sell as an organization (vs. my personal brand)

- Experimentation: I wanted to test how the e-Residency program would work for my specific use case

I am currently the only shareholder and employee of this entity and I'm not paying myself a salary yet.

Once you have an e-Residency you can easily incorporate Estonian limited liability companies from your computer.

I will cover the details in the e-Residency 104 blog post.

Overall I think that the Estonian setup has 2 target audiences:

- People who don't want to deal with their local sub-par bureaucracy (assuming the country is an EU member)

- People who are not EU residents but for some reason want to create an EU-based entity

I'm falling into bucket #1.

This overview should give you enough context before diving into the cash flow calculation scenarios 👇

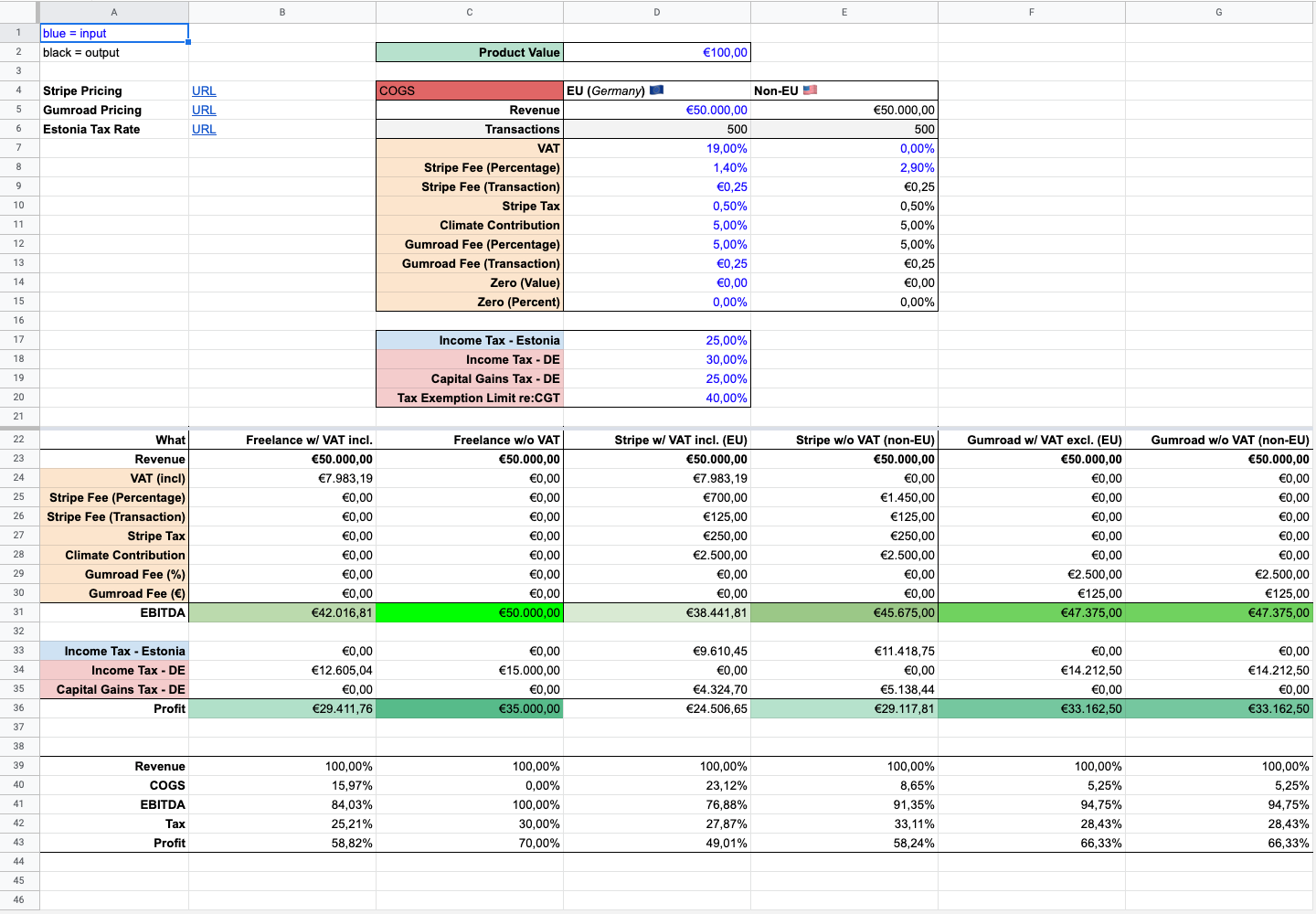

Case Study: Comparison of Cash Flows and Taxes of my Estonian Company vs. Freelance Activity

Let's get technical.

Here's my Google Sheet where I compare 3 hypothetical revenue streams in a simplified calculation.

It's simplified because I don't factor in my own effort (time spent) and other costs (software; contractors; etc.). This is a multi-variate calculation, which changes with the country of your primary tax residence/etc and many other factors.

I want to give you a directionally-correct feeling for potential cash flows and tax liabilities.

I'll explain the revenue streams as well as the core assumptions that I'm making. Sometimes I'll also reference a specific cell via this formatting.

Core Assumptions of the Calculation

- Personal Tax Residence: Germany

- 2 Customer Types: EU citizens (requires VAT) and non-EU citizens (VAT exemption)

- VAT: 19% assuming German customers

- Revenue: €50k

- Price per Sale: €100 (== 500 transactions)

- Pricing/Fees: Based on the €50k transaction volume, since for Stripe + Gumroad fees change with increasing volume

- Tax Rates: Directionally correct but not exact - especially in the case of Germany

- Climate Contribution: I chose to contribute 5% of my Stripe revenue to Climate initiatives - vis Stripe Climate. If you don't do that you can cut 5% out of your COGS (costs of goods sold).

Three Setups I Am Comparing

#1: Freelance activity in Germany 🇩🇪

- Billing clients through invoice

- VAT would be included in the invoice total (see cell

B24) - Income tax paid to German tax authorities

B34andC34→ tax rate changes progressively with increasing income

#2: Product sales via Estonian OUe 🇪🇪

- Billing clients via Stripe Payment Links (incl Stripe Tax

D10+ Stripe ClimateD11) - VAT inclusive billing

D24→ possible to change into VAT exclusive where the customer would have to pay VAT themselves on top of total billing amount - Stripe fees change depending on the type of credit card (non-US

D8vs. USE8) - Corporate income tax is paid when distributing dividends

D33andE33 - Personal capital gains tax in Germany, since I'm a tax resident in Germany

D35andE35

#3: Product sales via freelance tax ID 🇩🇪

- Billing clients via Gumroad's checkout product

- VAT exclusive billing

F24since Gumroad charges VAT directly to customers on top of the invoice amount - Gumroad has a progressive fee reduction based on certain total sales thresholds

- Income tax paid to German tax authorities

F34andG34→ tax rate changes progressively with increasing income

Go ham in this screenshot. A lot to unpack.

My main takeaways are:

- As a creator with a small income (<€10k) it is beneficial to invoice as a freelancer to maximize your take-home → caution: this gets progressively more expensive as your income increases.

- Once you grow beyond a certain size (depending on your own tax residence) it makes sense to incorporate as a legal organization. Estonia is an interesting option, especially if you want to cut down bureaucratic complexity.

- There are many levers you can pull to optimize profit: (a) payout modalities [dividends vs. salary payments]; (b) VAT inclusive vs. VAT exclusive billing; (c) personal tax residence; etc.

If you have any comments/feedback/questions or spot any errors, please ping me via DM on Twitter.

Bottomline: It Depends.

Tax is complicated and that's why you should consult a professional.

I am not a professional and the content above is just me sharing my best understanding of my own situation at this moment.

Secondly, taxation is a multi-variate problem, which highly depends on your own circumstances.

Nonetheless, I hope this post was helpful and that you can take away a thing or two for your own journey.

Now take a step back and make your own judgment.

103: How to Become an e-Resident

104: How to Incorporate in Estonia

105: How to Run an Estonian OUe on a day-to-day basis

FAQs

Q: Have you thought about billing your freelance activity via your Estonia co, and then bill the Estonia co with your freelance tax id to decrease the taxable income, while keeping savings into the co? (source)

A: Yes. Thought about it but haven't executed it yet because my income is very small at this moment and I don't surpass the threshold at which the company billing would make more sense.

I have the feeling once you get into the mid/higher five-digit income it makes sense to move from freelance billing to corporate billing.

Additional Resources

- How taxes and VAT work for Estonian companies (Companio.co)

- Global tax-optimization for location independence (Heavnn.io)

- Guide to Estonian e-residency for e-residents in Germany (e-Residency)